Your Trusted Partner in Navigating

the Complexities of BSA Compliance

Protect Your Institution from Financial Crime with Confidence.

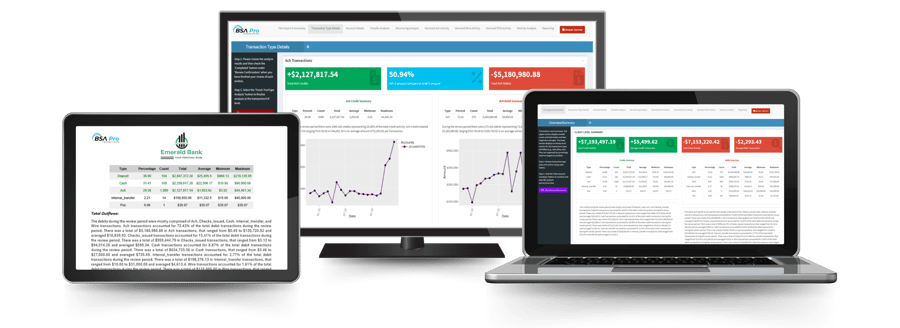

Experience unmatched efficiency as BSA Pro provides comprehensive data summaries, insightful narrative reports, and thorough audit trails. Streamline your BSA processes and uphold the highest compliance standards with ease.

Smarter Tech for a More Secure Future

Automate Your Processes

Minimize the burden of manual processing. We offer an automated method for analyzing transactional activity & produce natural language reports.

Enhance Team Efficiency

We directly reduce your BSA team’s time, effort, & cost to remain compliant. Teams can prioritize their efforts effectively, focusing on high-risk areas and optimizing resource allocation for maximum impact.

Minimize Errors

Our solution meticulously analyzes vast datasets and detects patterns of suspicious activity, minimizing errors and maximizing accuracy in compliance efforts.

Actionable Insights

Track trends and analyst performance with our advanced reporting, delivering insights to optimize processes, make informed decisions, and stay ahead of emerging threats.

Unlock Savings

BSA is the most significant compliance challenge in cost. BSA Pro reduces costs for alerts, cases, and high-risk reviews.

Seamless Integration

Seamless integration with existing core or compliance systems. BSA Pro was purposefully built to be system agnostic and can work with transactional data from any system.

How We Can Help

Deliver Consistent Results for Alerts, Cases, High-Risk Reviews

✓ Produce quality results consistent with industry best practices

✓ Effective for alert triage, case investigations, and high-risk reviews

Reduce the Impact of Employee Turnover

✓ Your in-house expert and primary analyst resource

✓ Provide a seamless user experience that requires little to no training

Manage or Avoid Backlogs

✓ Significantly reduce the time spent on manual review processes

✓ Help to quickly clear backlogs of alerts, cases, or high-risk reviews

Reduce Risk and Likelihood of Audit/Regulatory Findings

✓ Consistent outcomes regardless of an analyst’s experience level and is fully auditable

✓ Reduce time spent on manual processes

✓ Increase the likelihood of meeting internal & external reporting timelines

Our Technology & Expertise

Crafted by seasoned compliance experts, BSA Pro is the embodiment of real-world experience and understanding. It's not just a tool; it's a solution meticulously designed to meet the day-to-day challenges that compliance teams battle. We've been in your position, wrestling with cumbersome processes and sharing frustration over subpar systems.

Our BSA team has infused their profound knowledge and hands-on experience into every fiber of our product, fine-tuning it into a solution that elevates any BSA operation to new heights.

With a rich tapestry of backgrounds from across the financial sector – encompassing everything from traditional banking and fintech to consulting and auditing – the BSA Pro team delivers a holistic strategy for achieving regulatory compliance. Our expertise spans the entire spectrum of compliance needs, including risk assessment, customer and enhanced due diligence, transaction monitoring, suspicious activity reporting, model development and validation, sanctions handling, risk management strategies, and remediating consent orders.

Beyond their direct experience, our team members have significantly contributed to the field of compliance. They're not just participants but leaders and innovators, penning award-winning articles on pivotal topics such as the FFIEC examination manual and the nuances of SAR quality. Their active engagement in key industry forums, like SAS Fraud Week and the ABA Financial Crimes Compliance Conference, demonstrates a dedication to not only keeping pace with but also setting the standards in compliance best practices.

Frequently Asked Questions

What is the Bank Secrecy Act (BSA)?

The Bank Secrecy Act (BSA) is a crucial US regulation that outlines required record-keeping and reporting practices intended to fight against money laundering. One particular requirement of the Bank Secrecy Act (BSA) is that financial institutions are obligated to report cash transactions exceeding $10,000 within a brief period, regardless of whether they occur in single or multiple transactions.

What are the Four Pillars of BSA Compliance?

1. Designate a Compliance Officer: BSA Pro is an essential partner for any Compliance Officer seeking to better manage alert triage, case investigation, or high-risk reviews.

2. Develop Internal Control Process: BSA Pro establishes a consistent process for alert triage, case investigations, and high-risk reviews.

3. Tailored Training Program: BSA Pro was purposefully built to guide your team through the transaction review process, and act as your in-house subject matter expert.

4. Independent Testing (Audit): BSA Pro produces full audit trails to support teams during audits and regulatory examinations.

What is the Penalty for Violating the BSA?

Penalties according to a BSA civil action vary significantly based on the type of violation and the enforcement authority. The maximum BSA-related criminal penalty is $250,000 and up to five years imprisonment.

Contact BSA Pro, We'd Love to Help.

Complete the form below, and our team of experts will promptly connect with you to explore and address your unique needs.